The American Dream, the idea that any American citizen regardless of social class or circumstances of birth can rise to the top with enough hard work, is long dead.

Steven Brill, in his recent book entitled “Tailspin: The People and Forces Behind America’s Fifty-Year Fall–and Those Fighting to Reverse It” offers a detailed and convincing autopsy of the American Dream which constitutes the backbone of this long blog post.

According to Brill, the real divide in today’s America isn’t between Republicans and Democrats or conservatives and liberals, it’s between those at the top, the elites, and everyone else, the people of America. In Tailspin, Brill outlines the astonishing story of how a group of high-achieving students of the 1960s hijacked core American values to win the American Dream for themselves and kill it for everyone else.

Younger generations blame the boomer generation for the current state of America while older generations blame younger generations for being entitled, irresponsible and lazy. While both sides have a few valid points, the truth is that the majority of the members of either generation have nothing to do with America’s tailspin. Not only the younger generations are not the problem, but the boomers, except a tiny subset of them, weren’t the problem either.

Before we dive into the details of how the American Dream was killed, let’s first look at the statistical measurements that reveal America’s tailspin in the last 50 years.

Signs that the American Dream is Dead

1. Crippled Upward Economic Mobility

A defining feature of the American Dream is upward economic mobility — the ability of an individual to improve his/her economic status.

A low level of upward economic mobility points to the lack of opportunities to “make it” in America.

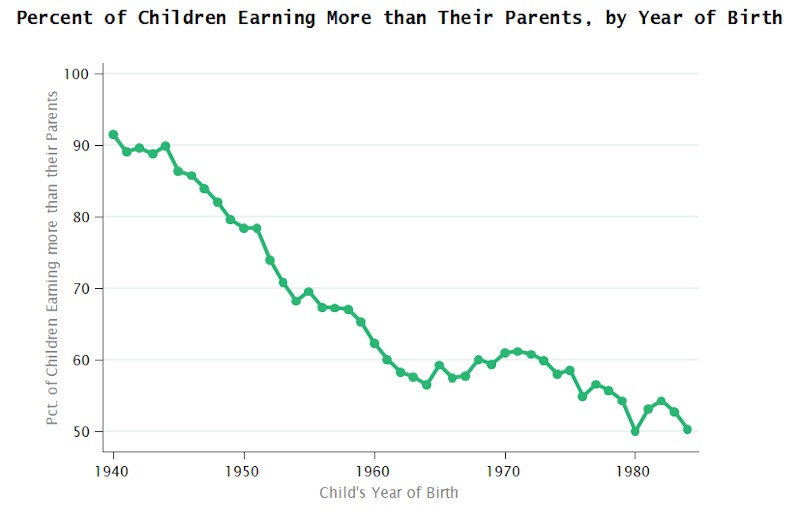

A 2016 study by professors at Stanford, Harvard, and Berkeley found that absolute mobility has fallen from approximately 90% for children born in 1940 to 50% for children born in the 1980s.1

2. Wages Have Been Stagnanting for Middle-Wage Workers, Declining for Low-Wage Workers

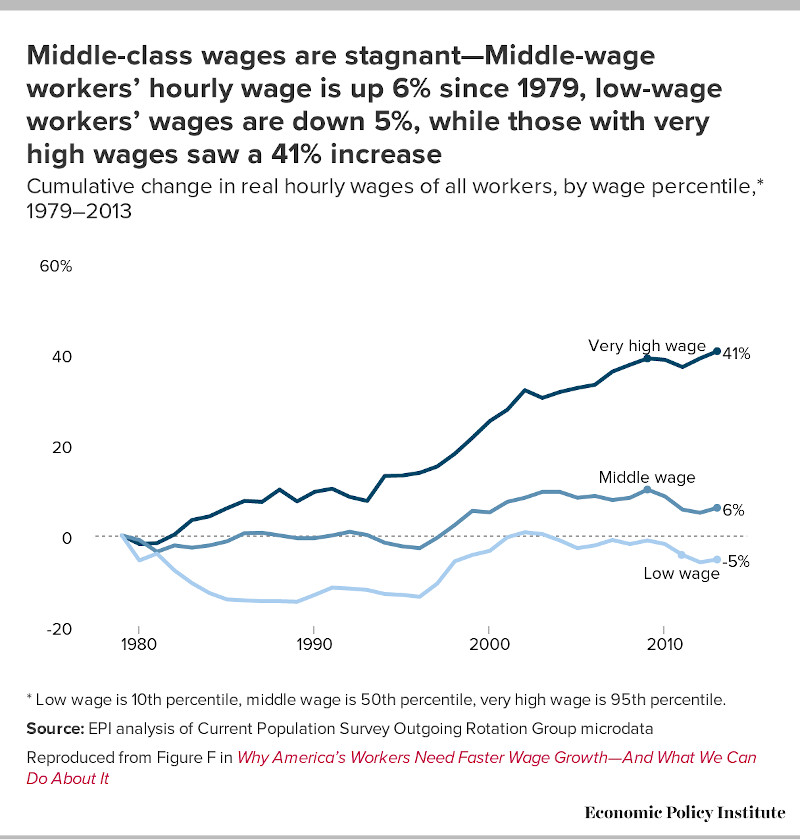

Wages in the USA have been stagnating for middle-wage workers and declining low-wage workers since the 1970s while the cost of living has been skyrocketing:

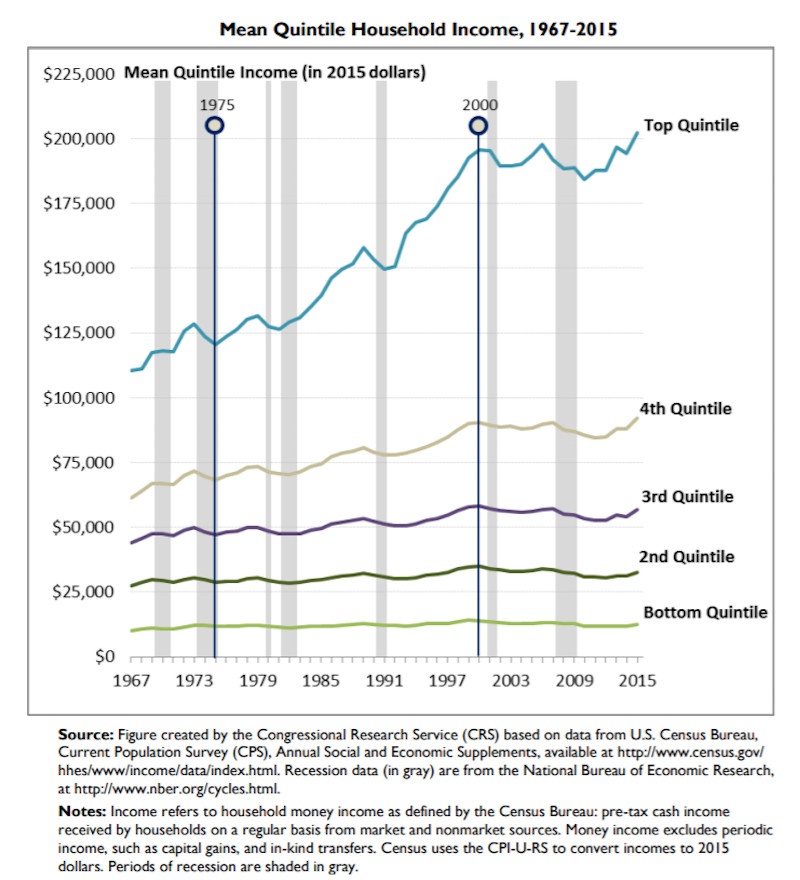

Household income has been stagnating since the 1960s for everyone else other than those at the top:

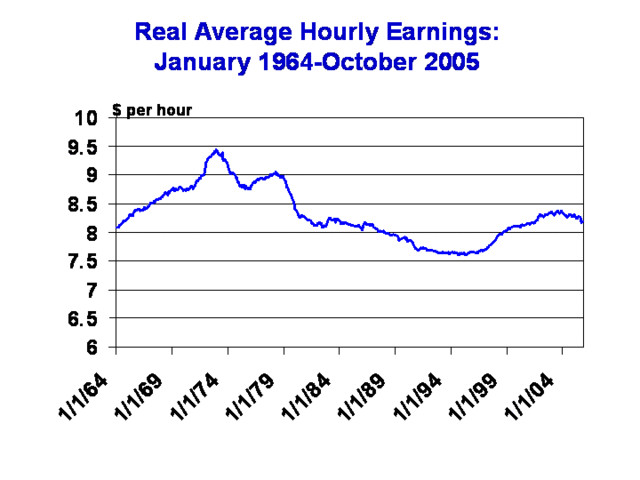

Politicians love to talk about job opportunities but the reality of the job market today is that good jobs are hard to find while most of the available jobs in the US economy are low-wage jobs. Real average hourly earnings have declined since the mid-1970s:

How Cost of Living Soared

While the wages have been stagnating or declining for the majority of American people and good jobs have been disappearing, the cost of living soared.

For example, health spending per person in America has increased a whopping 6-fold between 1970 and 2018 (adjusted for 2018 dollars) while earnings remained stagnant at best.

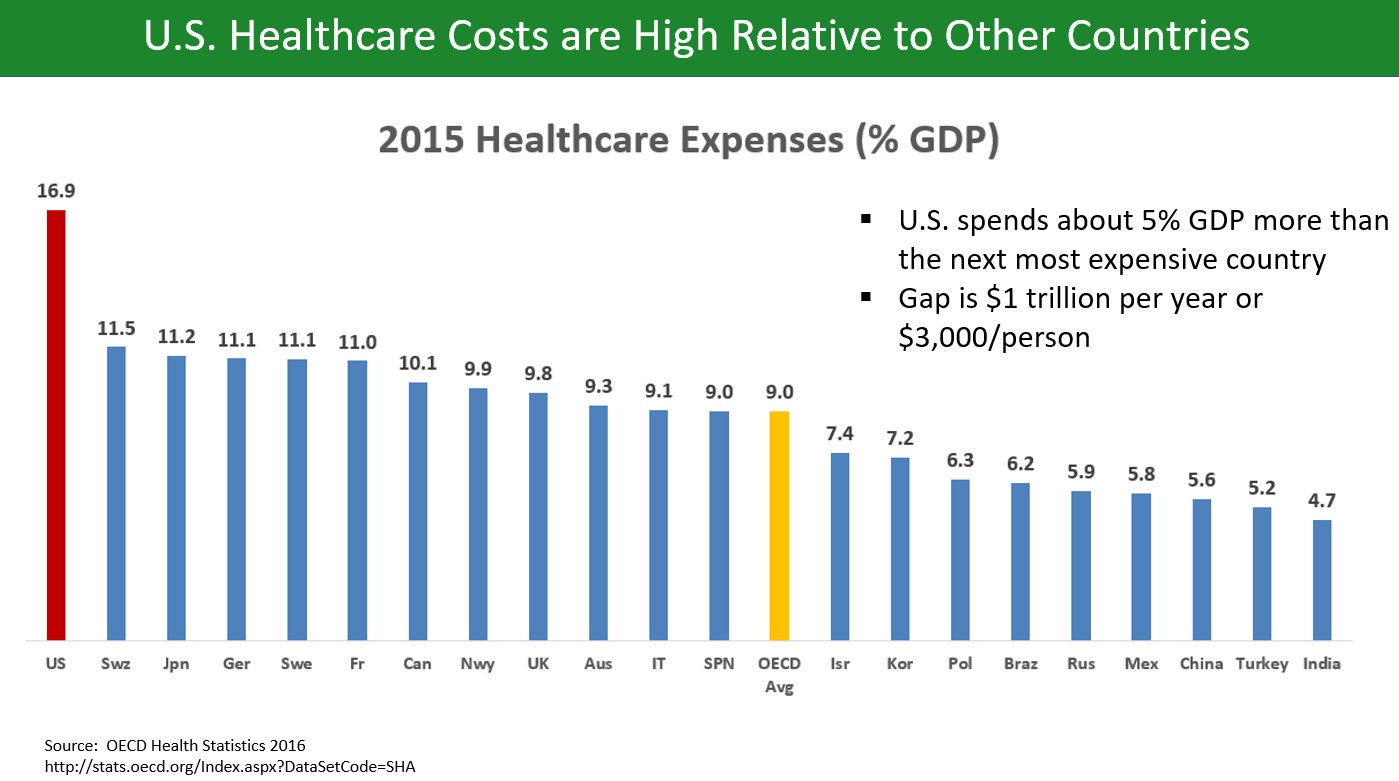

Health care costs in the United States are disproportionately high compared to other OECD countries:

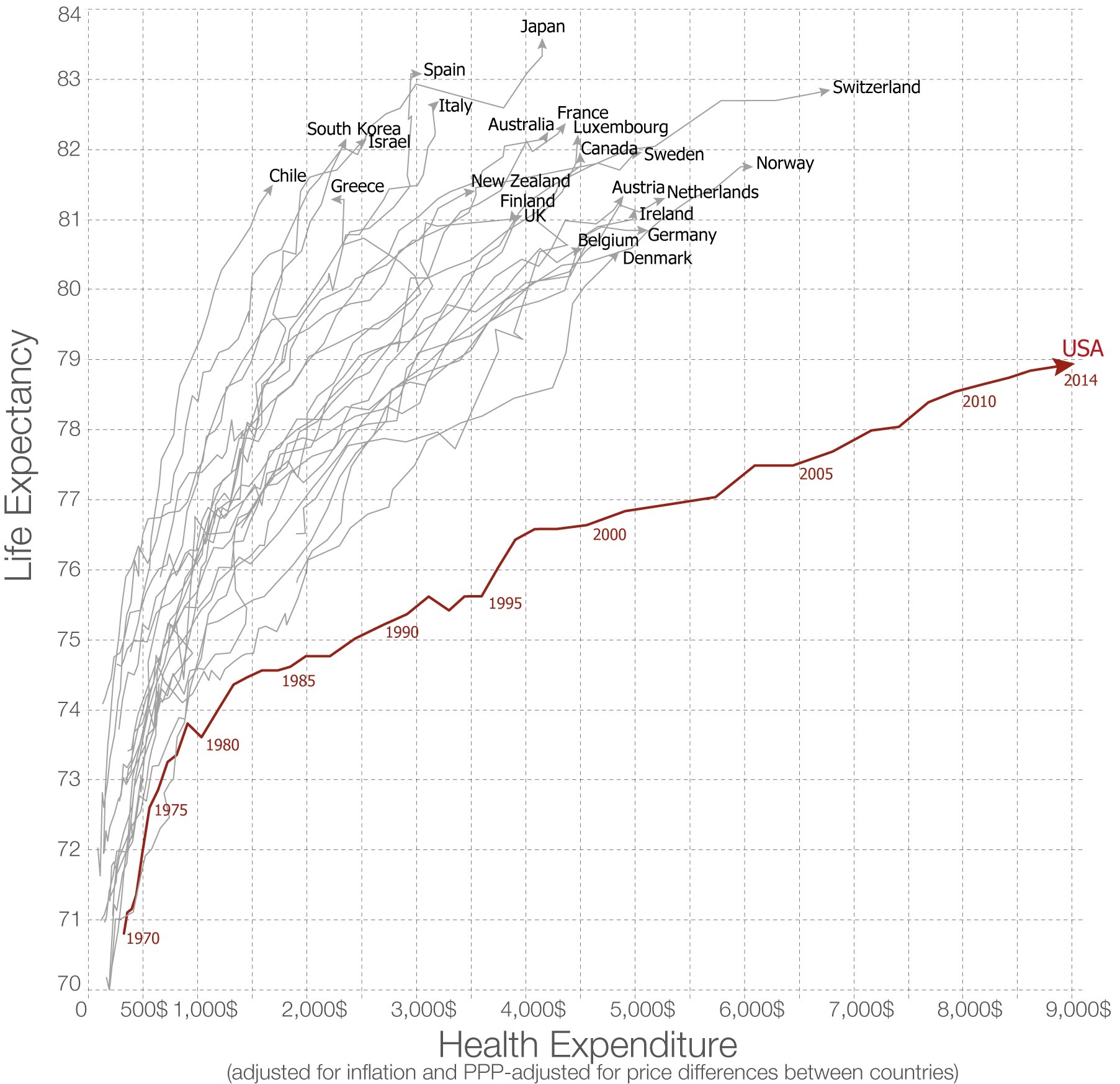

Despite increased health expenditure, life expectancy in the United States has fallen way behind other developed countries:

Consumer prices including the major items other than medical expenses such as rent, child care, and higher education have also been soaring.

Housing In The United States is “Seriously Unaffordable”

Housing affordability is calculated by dividing the median house price by the median household income:

- Severely Unaffordable: 5.1 and over

- Seriously Unaffordable: 4.1 – 5.0

- Moderately Unaffordable: 3.1 to 4.0

- Affordable: 3.0 and under.

According to the Annual Demographia International Housing Affordability Survey of 2019, The US median home price is $258,300 while the median household income is $56,500. Dividing these numbers get you 4.57, which puts housing prices in the United States in the category of “seriously unaffordable” on the brink of “severely unaffordable.”

The young people of today have to work for decades on end just to be able to buy an average house.

7 in 10 Americans are Living Paycheck to Paycheck

Increasingly more people in America are living paycheck to paycheck. A 2016 survey suggests that nearly 7 in 10 Americans have only $1,000 or less in their savings accounts.

Heidi Shierholz, a former chief economist at the Department of Labor, said in 2018 that “It’s astronomical what people need just to make it month to month. Given the high cost of transportation, housing, health care… There is often no wriggle room.”

3. America Is No Longer a Democracy, It’s an Oligarchy

Oligarchy is a form of power structure in which power rests with a small number of people whereas democracy is a form of government in which the people exercise the authority of government.

America, once a proud democracy, is today an oligarchy.

Here’s what a 2014 study by the American Political Science Association concluded about the current state of affairs in the United States of America:2

Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence. The results provide substantial support for theories of Economic-Elite Domination and for theories of Biased Pluralism, but not for theories of Majoritarian Electoral Democracy or Majoritarian Pluralism.

They are basically saying that America’s democracy evolved into a full-fledged oligarchy. American people have no say whatsoever on U.S. government policy. The meritocrats at the top are running the country and as we’ll see later, the interests of these people are at odds with the interests of the people of America.

Common good is no longer good for those at the top. The people running the country don’t want what’s good for American people. This is why the well-being of American people took a nosedive in the last 50 years.

4. No Level Competitive Playing Field for Small Businesses to Compete with Corporations: American Entrepreneurship is Vanishing

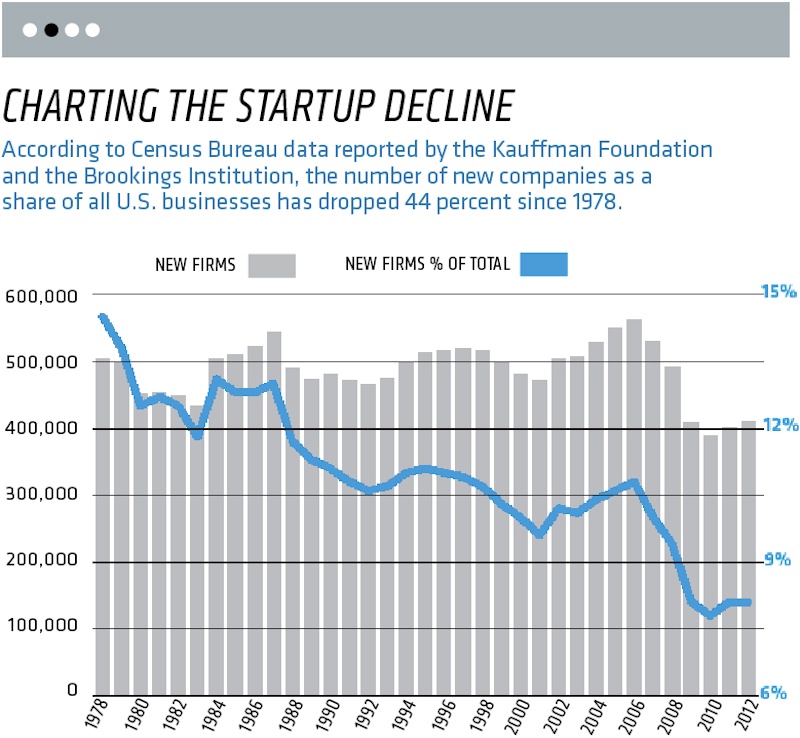

Entrepreneurship, one of the core tenets of the American Dream, has been on a free fall for over 40 years. As we’ll see in greater detail, those at the top hate competition. More entrepreneurs mean more competition and less money for them so they do all they can to block small businesses. Small businesses stand little chance to succeed in an economic environment that is controlled by people who hate competition:

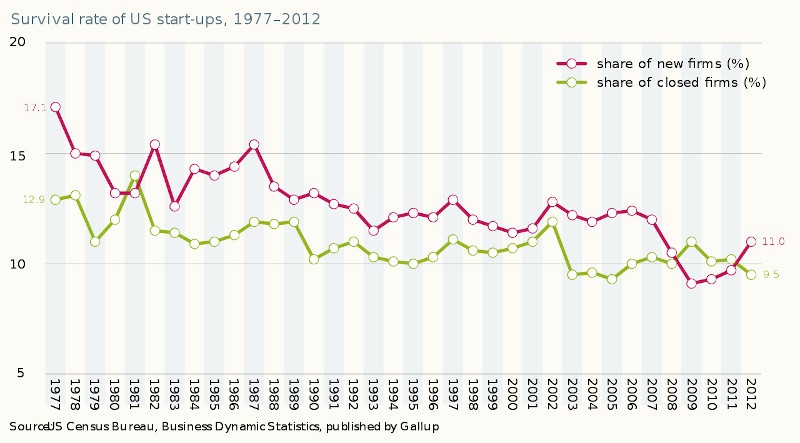

More American businesses are dying than they’re being born:

5. Income Inequality Has Been Skyrocketing

Income inequality is expected and fine in a capitalist economy but that’s only true if there’s a level playing field that’s representative of equal opportunity.

Not only the playing field isn’t level but also those at the top don’t get richer due to their extraordinary levels of value creation. As we’ll see in the following sections, the rich in America have been getting richer by moving, rearranging, or protecting assets (by legal and financial engineering) rather than creating them (with the exception of the tech industry).

The income gap between those at the top and everyone else has been increasing since the 1960s which is the result of the lopsided power balance in favor of the rich and powerful.

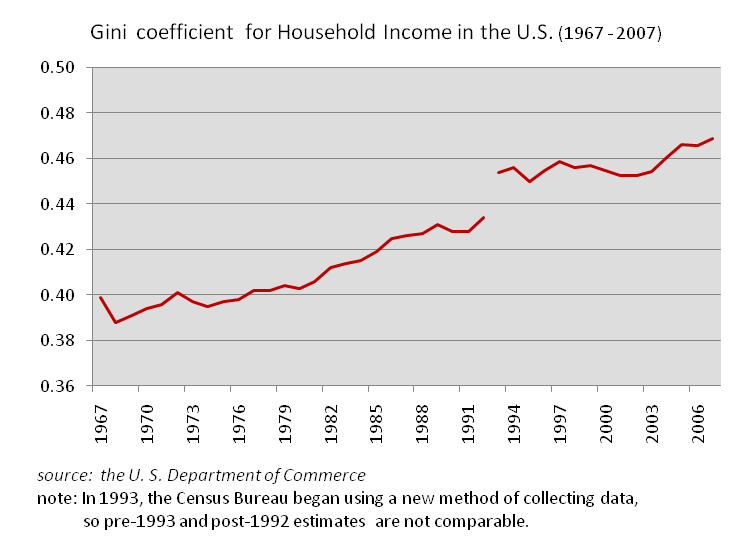

Here’s a graphical representation of rising income inequality in the United States since 1967:

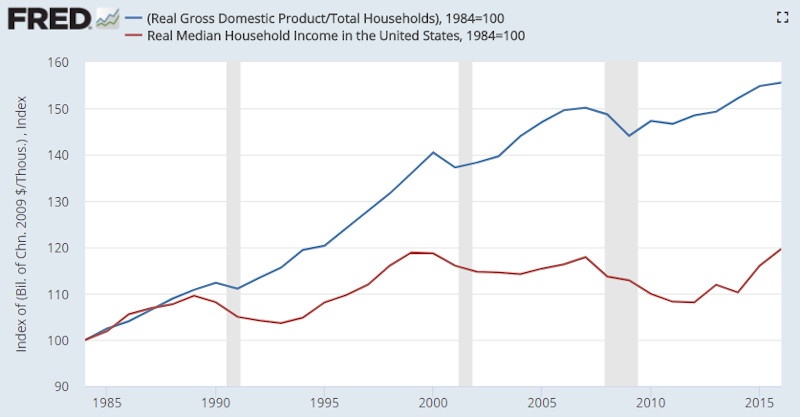

The increasing gap between real GDP per household and the real median income per household is another indicator of growing income inequality. All the money that pertains to the area between the two lines at the below graph flow into the pockets of those at the top:

Extraordinarily High Poverty Rate in the World’s Richest Country

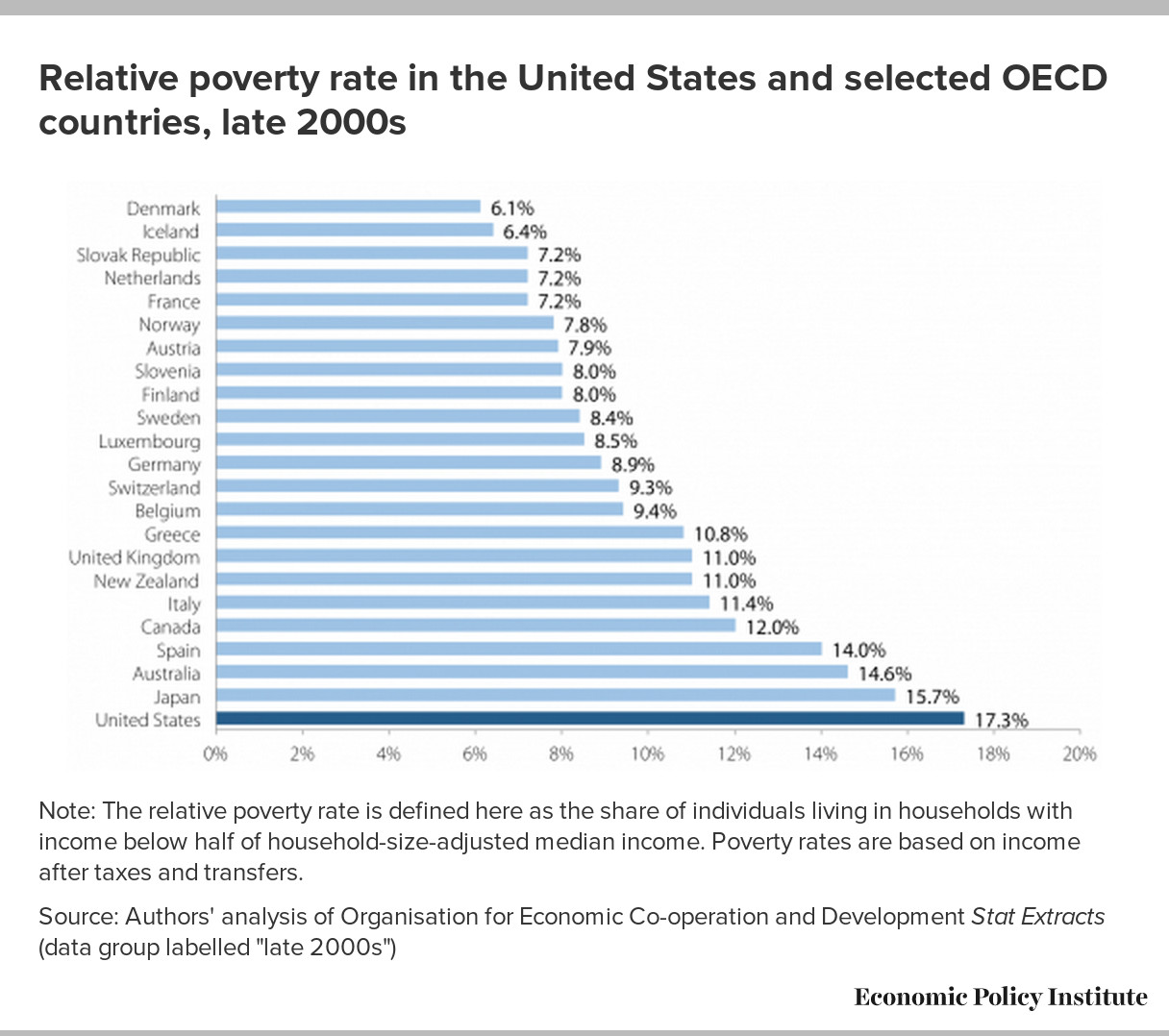

America also has the highest poverty rate among the thirty-five countries in OECD except for Mexico. The world’s richest country is incapable of taking care of its poverty-stricken citizens:

6. Declining Labor Participation Rate

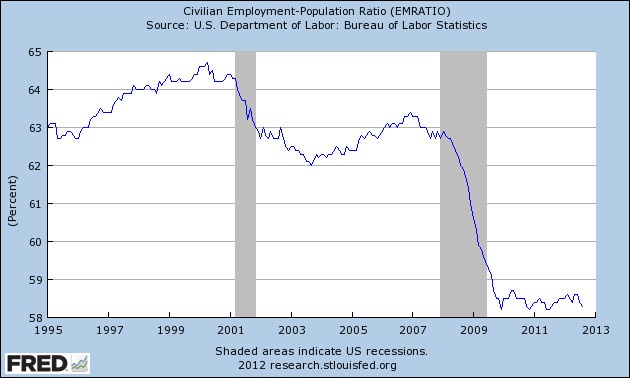

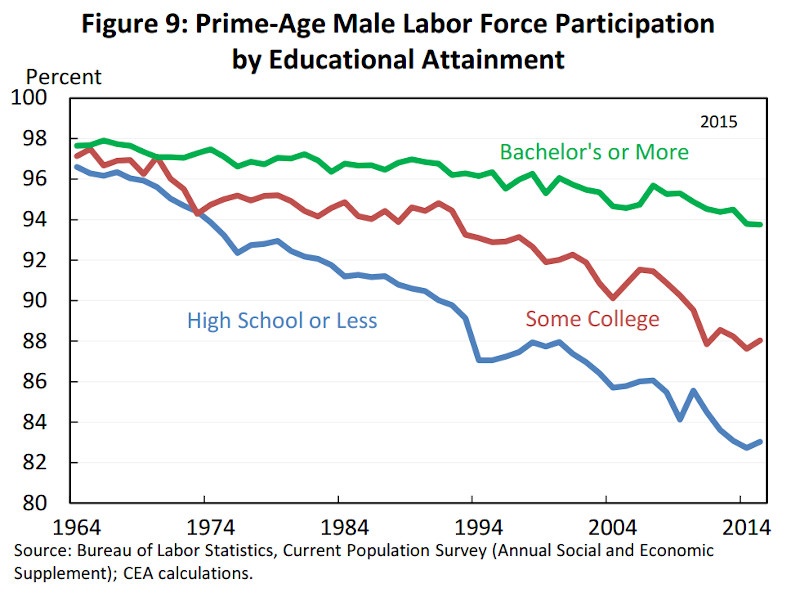

The number of Americans who refuse to work is increasing at record levels which is reflected in the ever-declining labor participation rates:

American men are leaving the workforce in droves since they realize more and more that the juice is not worth the squeeze:

The Protected Minority vs The Unprotected Majority

To understand why the American Dream died, we first have to make a distinction between the protected minority and the unprotected majority for the protected minority won the American Dream for themselves and killed it for everyone else in order to consolidate and protect their winnings.

The protected few are Wall Street bankers, elite lawyers, corporate oligarchs, and high-level knowledge workers including CEOs. The richest people in America.

These people are protected by the government as you witnessed during the financial crisis of 2008 when the government spent hundreds of billions of taxpayer dollars to bail them out while the unprotected, the people of America, footed the bill although they weren’t the ones responsible for the crisis.

The unprotected majority are the people of America, everybody else who is not one of the rich elite winners. They are unprotected because Washington abandoned them a long time ago. The American government which used to be “by the people, for the people” evolved into “by the privileged few, for the privileged few”.

These people of America, the unprotected majority, need the government to provide:

- protection for their way of life or to improve it,

- good public schools so that their children have a chance to advance,

- a functioning infrastructure — public transportation, roads, airports, sewage, water, electricity, etc.,

- a fair tax code,

- access to good health care for themselves and their families,

- safety nets for its citizens at the times of financial crises or natural disasters,

- job retraining programs to answer the changing labor requirements due to international trade, automation, and technology,

- a fair shake in consumer disputes,

- a level playing field for small businesses,

- a safe workplace, fair labor laws, and a livable minimum wage,

- a basic level of job security via labor unions and minimum-wage standards,

- programs to curb the poverty rate which is higher than all of the developed nations of the world

American governments have been failing these duties for the last 50 years. It doesn’t matter whether it’s the Republicans or the Democrats running the government. The protected few rigged the system in a way to ensure they get their way no matter which side is elected.

The protected elite don’t need any of the government functions mentioned above. They have access to the best private healthcare, education, transportation, and more. They benefit from a dysfunctional, incompetent government that otherwise could rein them in and threaten their winnings.

There are 20 registered lobbyists for every member of Congress. Corporations infested Washington with their lobbyists to manipulate the government to not only ensure the protection of their winnings but they also get bailouts in case the generous risks they like to take get them in trouble.

That American government abandoned its people is reflected in the dramatic decline in public trust in government from its peak of 77 percent in 1964 to 20 percent five decades later.

How did we arrive at this point? It’s a long story that started with the rise of meritocracy in the 1960s in colleges and universities of America.

The Rise of Meritocracy in American Colleges and Universities in the 1960s

The rise of meritocracy started at Yale and expanded into other colleges and universities from there.

Before the 1960s, Yale accepted most alumni sons who applied and they used a scoring sheet that measured the “all-around boy” which even included a checklist of desired physical characteristics.

From the mid-1960s on, Yale started to favor students who did better at standardized aptitude tests (such as SAT), a novel practice which later was followed by other colleges and universities.

This meritocracy revolution paved the way for the best and brightest students to gain access to the best education America has to offer.

The people who started the meritocracy revolution had good intentions. Little they did know that the beneficiaries of this revolution would proceed to win the American Dream for themselves and kill it for everyone else. Not only that but they would also feel justified at doing so because, after all, they had won it by merit and hard work rather than heritage or connections.

American Economy Gets Dominated by Legal and Financial Engineering

The winners of the meritocracy revolution of the 1960s went on to transform the American economy into what Steven Brill calls a “knowledge economy” or a “casino economy” dominated by legal and financial engineering.

Except for engineers who create software, the members of the new meritocratic elite have mostly worked as lawyers, bankers, executives, and consultants at prestige banks, businesses, consultancies, and law firms focusing on moving, protecting, or rearranging assets rather than creating them.

The meritocratic elite would thrive in the “casino economy” that they helped to expand at the expense of the people of America.

The Rise of Lawyers and Legal Engineering

Thanks to the meritocracy revolution of the 1960s, the number of lawyers doubled during the 1970s and rose by another 50% again in the 1980s. The legal industry got so big that, by the mid-1980s, it was bigger than steel or textiles and almost equal in size to the auto industry in terms of dollars generated.

Here are examples of jobs that these elite lawyers have been doing to generate massive profits for themselves and their clients:

- Engineering corporate mergers and takeovers,

- Creating tax shelters,

- Engineering new regulations related to consumer products, employment discrimination, worker safety, and the environment,

- Fighting anti-trust laws,

- Defending antitrust or consumer protection claims.

They’ve made themselves and their clients rich not by adding any value whatsoever to the society. In fact, what all of these jobs did was to subtract value from society and add that value into the pockets of themselves and their clients. They engineered a transfer of wealth (from the people of America to themselves and their clients) rather than a creation of wealth.

The purpose of engineering corporate mergers and takeovers, fighting anti-trust laws, and defending antitrust claims is to facilitate monopoly creation for their corporate clients. As we’ll see in greater detail later, monopolies are extremely profitable corporate structures for their owners but detrimental to society.

The purpose of engineering new regulations related to consumer products, employment discrimination, worker safety, and the environment, and defending consumer protection claims is to protect their big-pocket corporate clients from accountability for corporate misconduct while maximizing their profits in the process.

The Rise of Financial Meritocrats and Financial Engineering

In addition to the novel army of lawyers, the meritocratic revolution spawned another army of knowledge workers who acquired business-related degrees to engage in financial engineering.

Similar to legal engineering, financial engineering is not about creating value but about transferring it. This new breed of knowledge workers worked as financial engineers who also dealt with moving, rearranging, or protecting assets.

Here are examples of jobs that these financial engineers have been doing to generate massive profits for themselves and their clients:

- Inventing new types of financial instruments (such as funds, mortgages, bonds, stocks, derivatives, securities, etc.) or finding new ways to trade them,

- Stock buybacks,

- Corporate raiding, the debt-financed takeover, or leveraged buyout.

None of these jobs added value to society either. They too resulted in a transfer of wealth from American people to those at the top, further exacerbating income inequality. The rich got richer and the poor poorer.

The purpose of this financial engineering is to get rich as quickly as possible, at the expense of the common good. In case the financial engineers happen to break the law during their operations, their army of lawyers are there to protect them.

Inventing new types of financial instruments or finding new ways to trade them not only facilitates the transfer of wealth to those at the top but also endangers the economy as we’ve seen in the 2008 mortgage crisis. As we’ve also seen, they get away with putting the entire economy in danger because of the legal engineering and the lobbying power they amassed during the last 50 years.

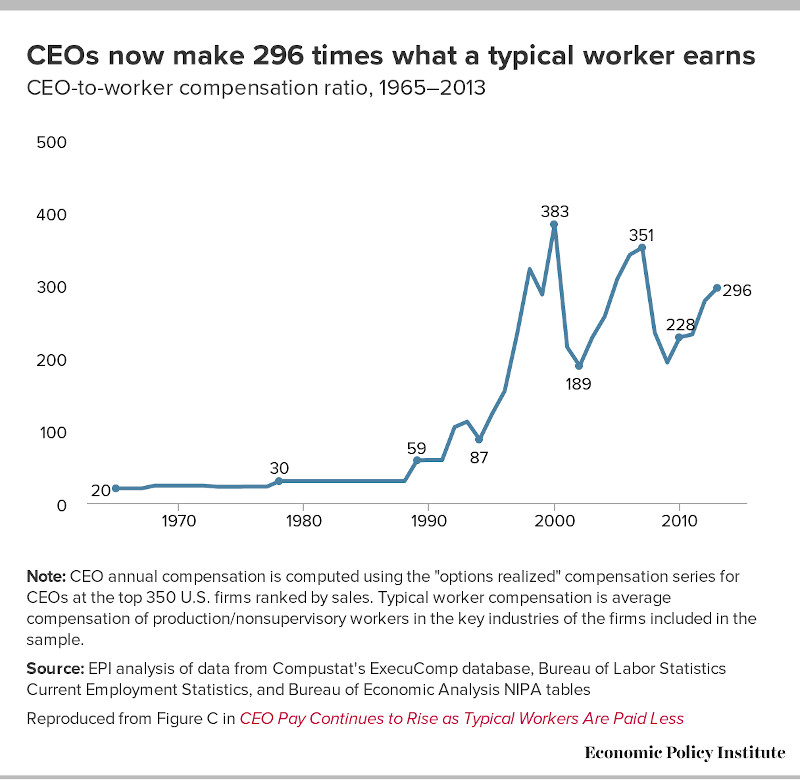

Stock buybacks are what big corporations do to keep their quarterly stock price high as CEOs and high-level managers get compensated according to the stock price. Stock buybacks result in higher stock prices which allow CEOs and high-level managers to earn more, which is reflected in the gap between the salary of the company’s average worker and CEO pay, the ratio of which was 20:1 in 1970, and skyrocketed to 300:1 in 2016.

Corporate raiding, the debt-financed takeover, or leveraged buyout are operations to facilitate the formation of monopolies which make their owners rich at the expense of society.

How “Short-Termism” Wreaks Havoc on American Economy

The American economy is driven by what can be called “short-termism” where the major concern of corporations is solely the quarterly stock price which counts as the primary performance measure for the CEOs and managers as they are compensated with stock or stock options rather than salaries.

When quarterly stock price becomes the sole measure of the performance of a corporation at the expense of everything else, here’s what happens:

- Research and development are crippled as they are long term investments which eat up on short term profits,

- Workers are underpaid or underemployed due to corporate efforts to squeeze pennies out of labor cost,

- Product quality is compromised as lower product quality translates to lower costs,

- Environmental concerns go out of the window as they also negatively affect short-term profits.

As a result, long term economic stability of the entire country is thrown under the bus for sweet short term profits. The single-minded focus of CEOs and managers of corporations on the stock price causes them to even borrow money for the sole purpose of keeping the stock price high. They don’t even need to worry about sinking their corporations because they not only don’t get punished or prosecuted for their wrongdoings but their corporations get bailed out by the government as well.

The sole focus of corporations on the stock price also caused stocks to become tools for gambling instead of investment. The average holding time for stocks was eight years and four months in 1960, two years and nine months in 1980 and just four months in 2016.

Monopolies

One of the main goals of legal and financial engineering of the meritocratic class is enabling the formation and the operation of monopolies since building a monopoly is the best way to make money in a capitalist economy assuming that there’s a demand for your product.

For example, if there was only one company that sells cellular phones, they would be able to charge more than the price that would emerge in a competitive market. Being able to charge higher prices dramatically increases profits.

While they are extremely profitable for corporations, monopolies are bad for society because they restrict output, increase prices, reduce economic welfare, restrict choice for consumers, and reduce consumer sovereignty.

In order to prevent the harm that the monopolies inflict on society, the government has anti-trust laws (on paper, at least) in place which are designed to enforce competition and prevent monopoly formation.

Corporations don’t want competition since competition drastically reduces their profits. They want to form monopolies to maximize their profits. The lawyers of the meritocratic elite have successfully been able to find ways to circumvent already loosened (by the Reagan administration) anti-trust laws that are supposed to prevent the formation of monopolies.

Their lobbying and legal and financial engineering activities coupled with the government’s incompetence help them to achieve their goal of forming monopolies to make astronomical profits at the expense of the people of America.

These people became so good at what they do that they are able to pull off monopolies even in industries where you’d think it’s impossible to do. For example, you would never think that airlines could be an industry that you could form a monopolistic company, right? There are a lot of airline companies so how could you form a monopolistic airline corporation?

Here’s how.

Do you remember the United Airlines passenger who was beaten up and dragged off the flight?

In 2017, a 69-year-old passenger of a United Express flight from Chicago to Louisville was injured while being dragged off the plane due to refusing to give up on his seat when he was told that the flight was overbooked (to maximize profits) and he was picked up as the passenger to leave the plane.

People of America were disgusted by how the airline treated its innocent customer and calls mounted for a boycott of the airline.

However, the boycott never materialized because it turns out that United Airlines had formed a monopoly on most routes which means that customers had no other choice than to fly United.

United never suffered from loss of profits and in fact, they even increased their passengers and profits after the fiasco.

They managed to form a monopoly thanks to the lobbyists and mergers and the government’s inability to implement its already lax anti-trust laws.

On a side note, the overbooking issue that gives the airlines the right to throw passengers out of a flight is also protected by the lawyers of the meritocratic elite. The small print legalese that no one reads when buying airline tickets (and signing many other contracts) protect the corporations from being held legally accountable for mistreating their customers.

Corporations merge or buy out the competing companies to form monopolies which leave the customers nowhere else to go in case they aren’t satisfied with the service. In many cases, they have their lobbyists in place to block competitors that might drive their prices and profits down.

Many American corporations form monopolies at the expense of the people of America. The American government not only is incapable of preventing this from happening, but it’s also helping these corporations to exploit the people of America more by allowing the lobbyist money to influence policymaking.

How Meritocrats Hijacked the First Amendment: Corporate Free Speech

One of the most important milestones in America’s tailspin is the hijacking of another core American value: Freedom of speech.

First Amendment to the United States Constitution originally protected the freedom of speech for individuals but not for corporations.

It was in the 1970s that the First Amendment was hijacked to include corporate free speech, which is the idea that corporations should have the same free speech rights as people because their arguments, too, contributed to the public dialogue hence commercial speech deserved First Amendment protection.

It was another beneficiary of the meritocracy movement, Martin Redish, a Harvard Law School graduate, who created the legal doctrine that corporations had the same First Amendment rights as people to trigger the chain of events that would result in the extension to First Amendment to allow unlimited corporate money to enter politics.

After a succession of cases that began in 1976, corporations were granted the First Amendment right to petition the government which in turn resulted in rich corporations deploying an army of lobbyists to Washington to press their cases in favor of corporate interests.

The number of firms that had registered lobbyists in Washington rose from 175 in 1971 to 2,500 in 1982. By 2016, the total number of registered lobbyists would be 11,000 which accounts for twenty lobbyists per member of the House and Senate, which represented 7,700 corporations and trade associations.

Lobbying spending of $3.1 billion in 2016 would reach a record high of $3.4 billion by 2018, and that number might be two times more than that if the money paid to Washington lawyers and consultants who weren’t registered as lobbyists but still worked to influence the congress was taken into account.

PAC (Political Action Committee) money saw a parallel increase. The number of PACs associated with business interests was 300 in 1971 which grew to 1,369 in 1980 and 2,353 in 2017.

Political money would eventually turn the balance of power in America upside down in favor of corporations for them to gain unprecedented political power to win more and protect their gains at the expense of everyone else.

It matters little if the members of Congress are democrats or republicans. They all tend to vote in favor of businesses because all of them are under the influence of lobbyist money. It was political money that brought them there in the first place as well.

What Do the Lobbyists Do?

The main goals of the corporations in deploying their army of lobbyists to Washington are to improve their winnings and impair the government in a way to protect their winnings, including those they won by breaking the law.

Here are a few examples of what the lobbyists in Washington do:

- Block government regulations governing marketing, the sale of personal data, product labeling, and even those aimed at protecting the sick from being targets of improper marketing of drugs that have life-threatening side effects,

- Block government regulations to enact a fair tax code,

- Block laws aimed at consumer or labor protection,

- Fight labor laws to weaken labor unions,

- Block laws for drugs to be added to Medicare’s coverage which would otherwise shield the elderly from increasingly high drug prices. The drug industry enjoys the highest profit margins among any industry and sector thanks to the success of their lobbying activities. Lobbying is directly responsible for the health spending per person in America to have increased 6-fold (in inflation-adjusted dollars) between 1970 and 2018 while wages stayed stagnant,

- Block government action to put job training programs in place for jobs that vanished due to automation, got outdated due to advances in technology, and workers who lost competitive edge due to international competition caused by global trade,

- Block laws that would hold corporate executives accountable for misconduct that in turn allows corporations to get away with breaking the law.

To the detriment of the unprotected majority of the people of America, the lobbyists have been successful at getting what they want.

The Influence of Political Money in American Elections

The influence of political money is not limited to deploying lobbyists to Washington.

The corporate free speech movement’s success also enabled unlimited money to finance campaign contributions which led corporations to spend hundreds of millions of dollars to put their favored candidates into office.

The Decimation of the American Working Class

We’ve seen in the opening section that during the last 50 years in America, the labor participation rate took a nosedive, and wages have been stagnating for middle-class workers while declining for low-wage workers.

Free trade, the decline of labor unions, technological innovation, and job automation coupled with a few other factors all played their part in the decimation of the American working class, ending their pursuit of the American Dream.

Free Trade

America enjoyed a trade surplus of $5.1 billion in 1961. Making new free trade deals with European and Asian countries seemed like a no-brainer considering the unmatched post-war superiority of the American manufacturing industry.

Labor unions cooperated with the Kennedy government to liberalize the country’s trade laws which they saw as an opportunity to enlarge markets and benefit more from the superiority of American manufacturing.

Unfortunately, things didn’t go as planned and foreign trade had dire consequences for American workers.

Foreign trade resulted in the outsourcing of jobs to lower-wage countries which weakened the bargaining power of American workers along with automation and industry’s fight against labor unions.

Technological Innovation or Automation

Advances in technology caused a lot of manual jobs to be replaced by automation which forced millions of American workers out of their jobs and as we’ll see in the following sections, both the employers and the government failed to enact job re-training programs to bring these workers back to the workforce.

The Decline of Labor Unions

American workers who did physical work enjoyed unprecedented power and prosperity during the post-war years thanks to the strength of labor unions and overall optimism in the country.

Labor unions possessed so much power that they didn’t even object to the Taft-Hartley Act which was passed in 1947 to recalibrate the balance of power between labor and business.

Everything went well for both labor and business until the mid-1960s. Between 1947 and 1960, Standard & Poor’s 500 stock index soared by 180 percent, and average family income also increased by 39 percent, both in inflation-adjusted dollars.

However, things would start to change in the mid-1960s when major employers started to suffer from the consequences of foreign competition.

Manufacturers rapidly started to shift work to the South which had right-to-work laws, in an attempt to decrease labor costs in order to be able to compete with foreign rivals. They were resisting the unions in the South while fighting harder than ever against unions at the plants that remained in the North.

Employers deployed their army of lawyers to fight against unions while the American government failed to protect the workers. The government was so incompetent at enacting laws against labor abuses that businesses didn’t even hesitate to break the laws that ostensibly protected workers because, thanks to the efforts of the corporate lawyers, breaking the law was far cheaper for businesses than obeying the law.

In 1947, 37 percent of the private workforce in America was unionized. It had dropped to 32 percent in 1960 and 22 percent in 1980. It would be just 6.4 percent in 2016.

The government’s failure to protect American workers meant victory for business and decimation for labor.

Other Factors that Contributed to the Post-1960 Decline of American Working Class

In addition to free trade, automation, and the decline of labor unions, here are some other factors that contributed to the decline of American labor:

- The franchising of fast food chains decreased the bargaining power of labor,

- Outsourcing became popular due to short-termism which resulted in the rise of contract workers and translated into the loss of fringe benefits, training, and the prospect of moving up in the ranks for workers,

- 300,000 people lost their jobs in the U.S. Postal Service since 1999 due to the rise of FedEx and email,

- 108,000 coal mining jobs were lost since 1960 because of changes in energy consumption due to natural gas, environmental regulations, technological advances, etc.,

- Jobs lost in the retail sector due to the rise of online shopping,

- The glory days of truck driving, once an iconic American blue-collar occupation, are long over.

How Washington Abandoned the Working Class

The new economy of automation, global trade, the decline of labor unions, short-termism, and financial and legal engineering marginalized the American working class during the last 50 years. Just in the 35 years between 1980 and 2015, the United States had lost 7 million of its 19.2 million manufacturing jobs.

American government’s failure to protect the working class caused a severely lopsided power balance between employers and workers in favor of employers.

Unlike the governments of many other developed countries, the government of the United States failed to deploy adequate job retraining programs for jobs lost due to automation and evolving technology. The government’s faint attempts to put job retraining programs in place never materialized due to government incompetence and resistance by lobbyists of big business because the big business was more interested in keeping the trade up and taxes down.

For example, 60 percent of young people in Germany participate in apprenticeship programs funded to a large degree by government grants and tax incentives while 5 percent in the United States participate in much less rigorous programs.

The government of the United States also failed to protect American workers from the detrimental effects of global trade. Policy measures such as tariffs, quotas, and relevant others could be implemented to protect the workers but they weren’t.

The combination of government incompetence and big business greed accelerated the decimation of American workers in the twenty-first century.

Bill Clinton administration promoted the admission of China into the World Trade Organization in May 2000 trusting the Cato Institute’s and US-China Business Council’s promises that the economic benefits to the United States are clear.

But the trade deficit with China ballooned up from $83 billion in 2000 to $347 billion by 2016 due to China’s low-wage competition and their failure to live up to their promises which enabled them to compete unfairly. The trade deficit with China also played an important part in the financial collapse of 2008 due to increased Chinese demand for U.S. Treasury bonds.

It was President George H. W. Bush who negotiated NAFTA (The North American Free Trade Agreement) and President Clinton who passed it through Congress in 1993. As a result, the trade deficit with Mexico grew from $15.8 billion in 1995 to $64.3 billion by 2016.

Polarization and Paralyzation of the American Government

A polarized and paralyzed government has been failing for the last 50 years to address the most important problems of American people:

- Income inequality,

- Education,

- Job training,

- The tax code,

- Infrastructure,

- Trade deficits,

- Health care.

How Polarization in Washington Causes Government Dysfunction

Checks and balances were put in place by the Founding Fathers to ensure the functioning of democracy without ignoring the rights of those who don’t enjoy majority support. This system depends on the goodwill of both Democrats and Republicans (or any of the opposing parties for that matter) to be able to compromise in order for laws for the common good to be passed.

However, checks and balances result in government dysfunction when they are utilized as tools for refusal to yield ground to the opposing party.

Democrats and Republicans in Congress are more interested in making sure from Inauguration day on that the president from the other party does not have a victory (even when the said victory is rooted in their own policy) than what’s good for the people of America.

The great policy initiatives of the 1950s and 1960s (such as Eisenhower’s interstate highway system, Kennedy’s nuclear test ban treaty, Johnson’s civil rights laws and Medicare and Medicaid) were passed with bipartisan support which is no longer possible in today’s polarized political environment.

Representative Democracy Replaced by Pure Democracy (Which Came to Undermine Democracy)

America was founded as a representative democracy — a system of government in which all eligible citizens vote on representatives to pass laws for them. This system worked fine since it would be a check on the impulsive will of the people until it eroded from the 1970s on into a pure democracy.

Beginning in 1970, the elimination of the role of state and local party bosses in picking the presidential standard-bearer caused the candidates to appeal to their party’s marginal voters (most liberal in case of Democrats and most conservative in case of Republicans) instead of moderates because marginal voters are the most motivated ones who are most likely to turn out to vote in a primary or caucus.

This evolution from representative democracy to pure democracy played a big part in the government’s evolution into a polarized and dysfunctional one.

Political Money Dominating American Politics

In the meantime, the changes in campaign spending laws after the Watergate scandal resulted in candidates becoming free-agent fund-raisers, hoping to raise limited funds from as many people as they could solicit and unlimited funds from independent groups that usually had a strongly conservative (for the Republicans) or liberal (for the Democrats) agenda.

This caused the winners of this process to not be beholden to the party or its leaders when they got to Congress. They had to keep their donors happy and pay attention to their marginal agendas instead of the interests of the general public or the party agenda.

How Gerrymandering Contributed to Polarization

Gerrymandering, which is a practice to establish an unfair political advantage in elections for a particular party or group by manipulating district boundaries, also contributed to the polarization of the Congress by eroding the influence of moderates because officeholders in both parties had little incentive to appeal across party lines and move to the middle.

Technology’s Contribution to Polarization

While Washington was becoming increasingly polarized, technological advances would further polarize the country by enabling most Americans to see what they want to see and ignore the other side.

The rise of the internet and the increase in the number of niche television channels allowed people to consume the kind of content that already agrees with them.

For example, aggregators such as the Drudge report (for conservatives) and The Huffington Post (for the left) curated news stories to reinforce the worldview of their respective audiences. Fox News catered to conservatives while MSNBC emerged as a liberal counter.

Social media allowed viewers to pick their favorite news sources and ignore the opposing views. Big data allowed advertisers to select and target voters with near-perfect precision.

The Result of Polarization and Paralyzation of the Government

The result of the polarization of first politics and the country and paralyzation of the government is that nothing gets done in Washington in favor of the American people.

The major problems of American people such as income inequality, education, job training, the tax code, infrastructure, trade deficits, and health care remain unaddressed in favor of fringe issues that don’t relate to the people of America or, as we will see in the next section, protection of corporate interests.

Moats: How the Winners Scheme to Protect their Winnings (Even What They Won by Breaking the Law)

The divide in America between the elite at the top and everyone means that the interests of the elites are often at odds with the interests of the people of America. What’s good for the American people is no longer good for those at the top.

A stronger, non-corrupt government is good for the majority of American people since they need government protection the most but the elites at the top don’t want a strong government for a strong government would get in the way of what they want to achieve. An incompetent and weak government is beneficial for those at the top.

How the Interests of the Elites Conflict with the Interests of the People of America

Labor Laws

Laws that protect labor and a higher minimum wage is good for American workers but the elites at the top don’t want that because it means that they have to pay more.

Health Care

Affordable health care is good for the people of America but the elites at the top don’t want that because it minimizes the profits of drug companies.

Drug companies have been successfully able to fight off price controls that prevail in other developed countries. Health care makes up for one-fifth of America’s overall economy and the health care lobby is by far the most heavily financed of any American industry.

The success of the health care lobby is the reason why health spending per person in America has increased 6-fold between 1970 and 2018 (adjusted for 2018 dollars) despite earning per person remained stagnant. It’s also the reason why U.S. health care costs higher than all of the developed countries.

Competition and Monopolies

The people of America benefit from competition between firms because competition drives prices down, improves the quality of the products and services that people consume, increases the variety and choices of consumption, promotes innovation, efficiency, and productivity, boosts economic development and growth, and provides greater wealth equality and a stronger democracy by dispersing economic power and greater wellbeing by promoting individual initiative, liberty, and free association.3

Nevertheless, as we’ve already covered, corporations hate competition because it drives down profits. The most profitable type of company for the elites is a monopoly, which means zero competition. As a result, they exert their lobbying power to obtain protection from competition. There are anti-trust laws in place to prevent the formation of monopolies but not only the laws are lax but also the American government is too weak to enforce them. They deploy their army of financial engineers, lawyers, and lobbyists to circumvent these anti-monopoly laws and ensure protection from the marketplace.

Big businesses in all industries including telecommunications, beer, hospital systems, cereals and canned foods, and media have been able to consolidate since the 1970s by taking advantage of weak law enforcement concerning lax anti-trust laws and using mergers and raiding tactics to concentrate power. They not only enjoy monopoly profits by being able to charge higher prices while offering inferior products, but they also enjoy lower costs by using their concentrated buying power to force suppliers to cut their prices which in turn further suppresses the wages that these suppliers could otherwise pay their workers.

Even supposedly non-profit hospitals form monopolies to charge higher prices for lower quality of service, which is another reason why health care costs have risen astronomically in the United States for the last 50 years.

A Level Playing Field for Small Businesses and Entrepreneurship

The people of America benefit from a level playing field for small businesses but the elites don’t want that either because they hate all kinds of competition even it comes from the small guy.

We’ve seen in the opening section that the number of new companies as a share of all U.S. businesses has dropped 44 percent since 1978. This is no accident. Corporations, thanks to their enormous power and their army of lobbyists and legal and financial engineers, have been stifling entrepreneurship by engineering an unfair advantage to ensure they shield themselves from the competition to enjoy monopoly profits.

In 2016, President Obama’s Council of Economic Advisers issued a report that concluded: “Consumers and workers would benefit from additional policy actions by the government to promote competition within a variety of industries.” A September 20, 2017, analysis by The New York Times’s Ben Casselman, stated that “the rising power of the biggest corporations, which many economists argue, is stifling entrepreneurship.” The result, he wrote, was a less dynamic economy and “anemic wage growth” because employment opportunities had become so concentrated among large employers. “Start-ups,” Casselman added, “are key drivers of job creation and innovation, and have historically been a ladder into the middle class for less-educated workers and immigrants.”

Customer Protection

American people benefit from government regulation to protect customers but the elite winners don’t want that because they don’t want to be held accountable for mistreating their customers.

Regulation of the Financial Markets

The people of America benefit from tougher regulations to rein in Wall Street. We’ve seen how much pain was inflicted upon the people of America during the 2008 financial crisis which basically happened because of the government’s failure to regulate Wall Street.

But the elites don’t want the government to regulate Wall Street because it not only prevents them from making astronomical amounts of money by financial engineering but they also don’t want to suffer from the consequences of breaking the law while doing so.

Infrastructure and Public Services

The people of America benefit from better public schools, airports, mass transit, power grids, and other infrastructure but the elite winners don’t want those because the government providing better infrastructure means that they have to pay more taxes. They don’t need the infrastructure anyway because they have access to private planes, private schools, luxury cars, generators, etc.

Campaign Finance Reform

The people of America benefit from a campaign finance reform but the elite winners don’t want that because it’s at odds with their desire to put their favored candidates in Congress.

A Fair Tax Code

The people of America benefit from a fair tax code but the elites don’t want that because more taxes mean fewer profits for them. They exploit tax loopholes with the help of their army of elite lawyers.

The American income tax code, which was twenty-seven pages when first passed in 1913 is now thousands of pages long, filled with tax preferences that are aimed at cutting tax mostly for corporations, managers of hedge funds and private equity and venture funds, and the country’s wealthiest families.

Wall Street Moats: Too Big to Fail, 2008 Crisis and Treasury Bailouts

50 years of lobbying and financial and legal engineering had so incapacitated the government to regulate and rein in Wall Street before it got too big that after the collapse of the housing market in 2008, the government could not allow the banking system to fail.

By the time it was the 2000s, decades’ worth of lobbying activities had eliminated the government regulations restricting the risks big banks and other financial players could take and the spread of their activities. When their gambles in mortgage-backed securities, credit default swaps, and synthetic credit default swaps resulted in the housing market collapse in 2008, they had to be bailed out with hundreds of billions of taxpayer dollars at the expense of mortgage holders and tax-paying Americans.

When the Obama administration arrived in 2009, there was an ostensibly agreed-upon sentiment that these financial institutions should be strictly regulated to avoid another similar financial disaster in the future.

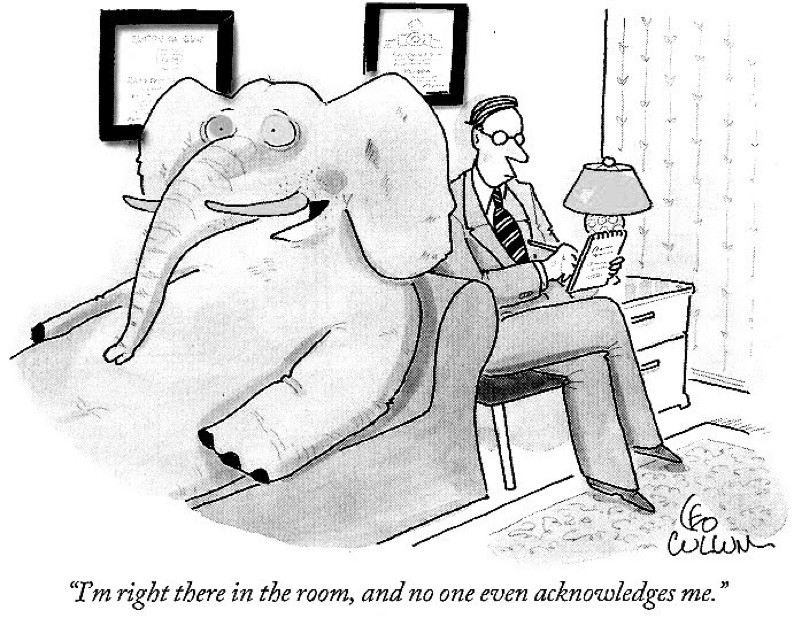

The most obvious solution was to break these giant financial institutions which had grown up to be “too big to fail” into smaller entities but lobbyists succeeded in blocking it which goes to show the overwhelming power of lobbyists over the American government. They succeeded in preventing the government from addressing the elephant in the room for which the government was eager to look the other way anyway.

Legalese in Small Print that Nobody Reads

The boilerplate contracts in small print when you sign up for cell phone service, credit cards, bank accounts, cable service, rent a car, etc. are also a product of legal engineering designed to protect the corporations from legal action that customers could take due to poor service or product quality or other causes of customer dissatisfaction.

Almost in all cases when the customer feels cheated or abused, they will find that they are bound by one of the clauses written in small print.

The United Airlines passenger we’ve seen above who was beaten up and dragged out of the plane didn’t know that he already agreed when he bought his ticket to give up his seat in case the flight is overbooked due to the airline selling more tickets than seats available on the plane.

Nobody reads what’s written in those contracts and that legal babble in small print is often illegible anyway for anyone who isn’t a lawyer. They serve as moats to protect those with power.

Slap on the Wrist for Corporate Crimes

Giant corporations are able to get away with committing crimes and at the times when they are caught the punishments they receive are far from being deterrent.

Here are some of the crimes that JPMorgan had to pay fines and penalties (some of which were tax-deductible):

- Helping to facilitate famed Ponzi-schemer Bernard Madoff’s fraud,

- Rigging bids on municipal bond offerings,

- Participating in an elaborate multibank conspiracy to defraud clients by fixing rates in a key $500-billion-a-day international exchange rate market,

- Violating the Foreign Corrupt Practices Act,

- Cheating credit card customers with fraudulent debt collection practices,

- Manipulating electricity markets,

- Illegally foreclosing on homes owned by people serving in the armed forces,

- Fraudulently selling toxic mortgage-backed securities in the run-up to the 2009 crash.

None of the senior executives of the bank were charged, nor any of these crimes cost JPMorgan the suspension or revocation of its banking licenses.

Not Only “Too Big to Fail” But Also “Too Big to Jail”

Most policymakers and prosecutors share the view that the national economy or even the global economy can’t afford the possible damage caused by sidelining or putting out of business a giant financial institution.

Not only these big banks had to be bailed out because they are too big to fail, fully prosecuting them had to be avoided as well because they also got too big to jail.

When the American government fails to deliver justice because these institutions are “too big to fail” and their executives are “too big to jail”, the people of America get cynical because they witness that the basic rules of responsibility and accountability do not apply to those at the top.

“Too big to jail” was witnessed once again when HSBC was spared prosecution in 2012 for helping drug cartels launder money and allowing Iranian and Libyan entities linked to terrorism to evade sanctions.

Steven Brill, being a lawyer himself, says that “this undermines one of the core goals of criminal law: deterrence” and adds that the prospect of a stint behind the bars might “weigh so much more heavily on white-collar offenders than it may on street criminals.” He also draws attention to the consequences for a democratic society that “shielding any significant group of people, especially the powerful, from accountability undermines the premise of a democratic society.”

In 2016, The Wall Street Journal published a report on charges brought against big banks – such as JPMorgan Chase, Citigroup, Bank of America, Morgan Stanley, Wells Fargo, and Goldman Sachs – regarding the frauds associated with 2008 financial crisis.

The report came out with the title “Wall Street Crime: 7 Years, 156 Cases and Few Convictions” and stated that “proceedings against individual bank employees are rare, and authorities have had difficulty winning cases.”

Wall Street had gotten not only “too big to fail” but also “too big to jail.”

“Too Big to Manage” Joins “Too Big to Fail” and “Too Big to Jail”

CEOs and high ranking executives of big corporations also escape from being held responsible for corporate crimes because “they are too removed from a firm’s day-to-day organizations.”

They still receive their bonuses and payments resulting from corporate crimes but when it comes to being held responsible and accountable for the same crimes they can’t be proven guilty due to the company’s massive organization chart.

They profit massively from corporate free speech (that corporations have the First Amendment rights as people) but when it comes to corporate crimes they are suddenly inseparable from their corporations and can’t be held responsible as if they were people.

How Drug Companies Make Tens of Billions of Dollars by Breaking the Law and Getting Away with It

Off-label marketing, promoting drugs for uses not approved by the FDA, is prohibited by law but 8 out of 9 major drug companies still do it because it’s so profitable.

Although federal officials regard these practices as crimes that endangered or even killed thousands of people and all 8 corporations pled guilty and paid large fines, no executives at the companies were prosecuted.

Law enforcement against off-label marketing is so weak that it’s more profitable for drug companies to break the law than to obey it. The fines drug companies receive by breaking the law dwarfs the enormous profits they make so they continue to do it anyway with complete disregard for the health dangers they inflict on the people of America.

The Staggering Incompetence of the U.S. Government

Of all the government functions in America, the only ones that decently function and benefit the people of America are national defense, traffic lights, courts, renewing passports, and licenses.

For everything else, the government is not functioning which is only a problem for the people of America but not for those at the top because people at the top profit from an incompetent government and they don’t need the government for their needs as they are able to get them met privately.

Years of erosion due to meritocracy, financial engineering, political money, due process, democratic reforms of the political process, and polarization have incapacitated the government from serving its unprotected people who need it the most.

How Public Employees Get Away With Poor Performance

In 1998, the General Accounting Office (renamed as Government Accountability Office in 2005) issued a series of reports that highlighted how the federal government’s performance ratings of civil service workers, especially managers, was a sham.

Civil servants have almost impregnable due process protections before they could be fired or disciplined.

Despite the fact that almost no government function properly works, less than half of one percent of the country’s millions of federal, state, and local civil servants get fired for performance-based reasons in any year, and those who do get fired usually get their jobs back with the help of law firms that specialized in getting them reinstated.

How the U.S. Government Fails to Attract or Keep Talented and Competent Employees

Not only the U.S. government fails to deal with poorly performing employees, but it also fails to hire and keep talented employees as well.

Just as the poor performers go underpunished, those who do their jobs well are underpaid and under-rewarded which removes the incentives for workers to perform better in a public sector job.

Talented people don’t prefer to work for the government as they would make significantly less than what they would make in the private sector.

How the Government’s Private Contractors Thrive

While the government fails to provide enough pay to attract talented employees, it overpays contractors due to its own incompetence, the network of lobbyists working in favor of the contractors, and the members of Congress who receive campaign contributions from the contractors or want to benefit from contracts that bring jobs to their districts.

America’s Broken Infrastructure

Deteriorating highways, roads and power grids, rotting water mains, broken mass transit systems, dilapidated airports, decrepit public school buildings, worn-out bridges, ports, dams, levees, parks, and sewer systems are daily reminders for American people that the American government has been failing its most obvious responsibility — building, maintaining and improving the services and facilities necessary for a country to function.

The Cost of Neglecting Infrastructure

According to a 2016 report by the American Society of Civil Engineers, failure to act on current infrastructure gaps is projected to cost $3.9 trillion in losses to the U.S. GDP, $7 trillion in lost business sales, and 2.5 million lost American jobs by 2025. On top of those costs, hardworking American families will lose upwards of $3,400 in disposable income each year – about $9 each day.

Considering that the gap between projected infrastructure spending over the next ten years and what is needed to be spent to repair, maintain, and improve the country’s infrastructure is $1.1 trillion, the economic benefits to the people of America of investing in infrastructure is obvious.

Despite the enormous cost of failing national infrastructure to the people of America, net federal spending for non-defense infrastructure projects was a paltry $10 billion in 2017. To put things into perspective, ten billion dollars is the cost of sixty-four of the 2,457 F-35 fighters purchased by the government.

Why American Government is Failing to Fulfill Its Most Basic Responsibility: Infrastructure

Political Money

The rise of political money caused the government to abandon its people for the sake of serving the protected few.

We’ve already seen that the American government is controlled by corporations and since the common good is no longer good for those at the top, infrastructure going neglected shouldn’t come by surprise.

The rise of political money produced public officials who represent the agendas of their benefactors, not the interests of the people of America. These public officials created an anti-tax and small government agenda that precluded adequate infrastructure investments.

Polarization in Washington

We’ve seen in previous sections how Democrats and Republicans in Congress came to be more interested in preventing the other party’s victory than what’s good for the people of America.

This polarization blocks any significant bipartisan solutions for the common good of the American people even for causes as obvious as infrastructure.

Due Process Protections

Pressure by environmentalists and community groups results in a bloated due process which in turn delays projects for decades or increases costs to the point that projects end up shelved.

The Poor People of America

It was 1962 when Michael Harrington wrote his book The Other America: Poverty in the United States which awakened the country to the existence of 38.6 million Americans living in poverty which at the time accounted for 21 percent of the population.

The book moved the nation, which resulted in a parade of government programs such as Medicare, food stamps, Medicaid, Head Start, and legal services for the poor along with an increase in funding for the welfare program Aid to Families with Dependent Children.

The fight against poverty paid off. By 1973, the number of Americans living in poverty was reduced to 22.9 million, 11.3 percent of the population.

The numbers started climbing up again in 1974, to settle between 13 percent and 15 percent until 2015.

With the rise of meritocracy which resulted in a marginalized working class and the disruption of Washington by political money, America’s progress in eradicating poverty first stopped then it was reversed.

In a broader low-income category, the number of near-poor Americans – living below twice the poverty line – was 95.2 million in 2016, or 29.8 percent,4 which probably explains why it’s found by the Federal Reserve in 2018 that 40% of Americans can’t cover a $400 emergency expense without selling something or borrowing money.5

Not only the war on poverty had stopped and reversed, but middle-class Americans were also earning less, which are the natural results of that during the last years in America, a small group of meritocratic elite got richer and the rest of the people got poorer. Although America is materially far richer compared to 50 years ago, much of the increased wealth has gone to those at the top.

The United States has the lowest minimum wage (relative to median wage) of any wealthy nation. For example, the minimum/median wage percentage as of 2018 was 62 in France, 54 in the United Kingdom but it was below 35 percent in the United States. 6

The primary reason that the minimum wage is so low in the United States is the lobbying efforts of corporations to prevent increasing it in an attempt to squeeze out the most short term profits by keeping their labor costs low.

While the unemployment rate sharply decreased from 2009 to 2017, the majority of the new jobs are low-pay or part-time. More than six-in-ten Americans said “good jobs are hard to find where they live” in a survey conducted in 2016.

Resurrecting The American Dream

Steven Brill says that he conceived Tailspin as an “autopsy of the American Dream” when he started, but he also realized that there was another part of the story which assured him that “the patient isn’t quite dead yet — there are some cures that are still possible.”

The book’s complete title is “Tailspin: The People and Forces Behind America’s Fifty-Year Fall–and Those Fighting to Reverse It”. We’ve covered the parts on “The People and Forces Behind America’s Fifty-Year Fall” so far and now we’ll briefly talk about “Those Fighting to Reverse It”.

Those Fighting to Reverse America’s Tailspin

Amherst and Baruch Colleges are fighting against entrenched meritocracy by recruiting more students among the economically disadvantaged.

The Center for Responsive Politics tracks the effects of money and lobbying on elections and public policy. Their website OpenSecrets.org in their own words “is the nation’s premier website tracking the influence of money on U.S. politics, and how that money affects policy and citizens’ lives.”

Issue One is another non-profit focused on political money that, by their own words, “seeks to reduce the role of money in politics. It aims to increase public awareness of what it views as problems within the present campaign finance system, and to reduce the influence of money in politics through enactment of campaign finance reform.”

Pursuit is a non-profit organization ran by Jukay Hsu in Queens, New York that raises software developers. Their graduates get hired for tech jobs by some of the biggest companies in America including The New York Times, IBM, Spotify, and many more.

Year Up, founded in 2000 in Boston by Gerald Chertavian, is another non-profit organization that operates in 19 locations in America and offers training and mentoring to prepare its students for entry-level, middle-skill jobs. Microsoft, Verizon Media, and Bank of America are some of the companies that hire their graduates.

The Bipartisan Policy Center is a Washington, D.C.-based non-profit think tank operating as a resistance movement against polarization in Washington, focusing on bipartisan solutions to America’s key challenges.

Robert Post, a professor of law and the former Dean at Yale Law School is fighting against the hijacking of the first amendment.

Better Markets is a non-profit organization that supports the financial reform of Wall Street and strives to make the financial system of America to work for all Americans again.

Partnership for Public Service is a nonprofit, nonpartisan organization that fights against the talent drought that the government is suffering from and strives for a more effective government for the American people.

Philip Howard’s Common Good is working to prevent infrastructure projects from taking decades to be completed or sidelined indefinitely because of bloated due process regulations.

The Center on Poverty and Inequality of Georgetown University Law Center works with policymakers, researchers, practitioners, and advocates to develop effective policies and practices that alleviate poverty and inequality in the United States.

For greater detail on how these people and institutions are fighting to reverse America’s tailspin, I urge you to read Steven Brill’s brilliant book.

Will Americans Retake Their Democracy?

Steven Brill bets that they will but this will not be a revolution of those on the left against those on the right. It will be about the unprotected demanding that the protected become responsible and accountable.

The growing demand for reliable sources of information finds reciprocity by multiple print, online, and television news organizations. The people and organizations mentioned in the previous section find growing support and talent joining their cause.

Any kind of a triggering event could cause the public to reach a breaking point, decide that enough is enough, and storm the moats.

Read More: Tailspin: The People and Forces Behind America’s Fifty-Year Fall–and Those Fighting to Reverse It.

Footnotes

- The fading American dream: Trends in absolute income mobility since 1940 BY RAJ CHETTY, DAVID GRUSKY, MAXIMILIAN HELL, NATHANIEL HENDREN, ROBERT MANDUCA, JIMMY NARANG. SCIENCE28 APR 2017 : 398-406

- Gilens, M., & Page, B. (2014). Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens. Perspectives on Politics, 12(3), 564-581. doi:10.1017/S1537592714001595

- Maurice E. Stucke, Is competition always good?, Journal of Antitrust Enforcement, Volume 1, Issue 1, April 2013, Pages 162–197

- Poverty and Progress: Poverty is Down in the U.S., but New Threats Ahead. Coalition on Human Needs. October 26, 2017.

- Report on the Economic Well-Being of U.S. Households in 2017. Board of Governors of the Federal Reserve System. May 2018.

- Minimum relative to average wages of full-time workers. OECD Stats.